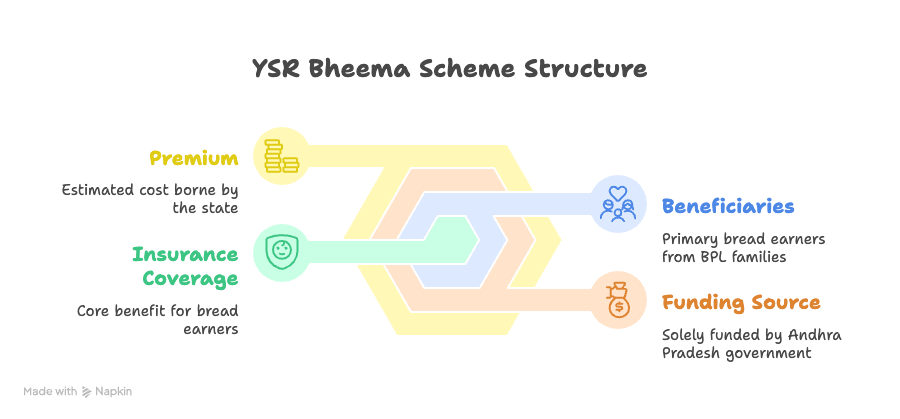

The YSR Bheema Scheme is an insurance program that the Government of Andhra Pradesh established to offer financial security to the families of low-wage and unorganised workers in the event of accidents or death.

The Andhra Pradesh government launched the AP YSR BheemaScheme 2025 on October 21, 2020. Under Bheema YSR, the state government will provide insurance coverage to primary breadwinners in families below the poverty line (BPL).

The current YSRCP government has fulfilled another election promise by launching its flagship YSR Bhima Scheme. In this article, we will provide you with all the Small and big YSR BimaScheme Details.Read More in Details On Volunteerbhadra

YSR Bheema scheme details

Let’s understand the YSR Bheema details. The AP YSR Bheema Scheme benefits 1.41 crore “Primary Bread Earners” from BPL families in the unorganised sector. The entire insurance scheme will be funded solely by the Andhra Pradesh government.

The estimated value of the premium that would be borne by the state government will be Rs. 510 crore. As the number of YSR Bheema Scheme beneficiaries grows in the coming days, the premium amount is expected to rise even more. The state government of Andhra Pradesh will pay the YSR Bhima Scheme premium once some of the eligible citizens’ bank accounts are operational.

YSR Bheema scheme eligibility

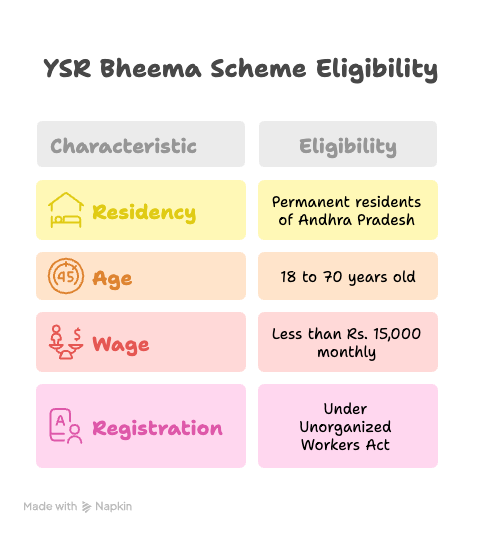

There are some Eligibility Criteria for the Scheme, so in this Paragraph, we have discussed the YSR Bheema Scheme eligibility. Interested Aspirants Must Read the Below Paragraph Carefully.

• Applicants must be permanent residents of Andhra Pradesh.

• Unorganized workers between the ages of 18 to 70 years old are eligible.

• The workers should have a monthly wage of less than Rs. 15,000 and should be enrolled via the Praja Sadhikara Survey.

• All unorganized workers need to register under the Unorganized Workers Social Security Act, 2008.

If you are fit for the YSR Bheema Eligibility Criteria, then Apply For the Scheme.

ysr bheema scheme age limit

The Andhra Pradesh Government has Set An age limitation for the beneficiary. The YSR Bheema Scheme is available to primary breadwinners of BPL families in Andhra Pradesh who are between 18 to 70 years old.

Age-Based YSR Bheema Benefits

• Applicants aged 18 to 50 years will receive Rs. 5 lakh insurance coverage for accidental death and total permanent disability.

• Applicants aged 51 to 70 years will get Rs. 3 lakh insurance cover for accidental death and total permanent disability.

• Furthermore, if a person dies naturally between the ages of 18 and 50, their family will receive Rs. 2 lakh.

• All applicants aged 18 to 70 years will receive Rs. 1.5 lakh in the event of partial or permanent disability as a result of an accident.

How to Check Your YSR Bheema Status

Applicants who have applied for the YSR Bheema Scheme can check their status online. Detailed Information About how to check YSR Bheema Status.

• Visit the official AP YSR Bima website here.

• Look for the Claim Status Search option.

• Enter your Aadhar number, Rice Card number, or Claim Code.

• Click Search to view your AP YSR Bhima claim details.

YSR Bheema claim process

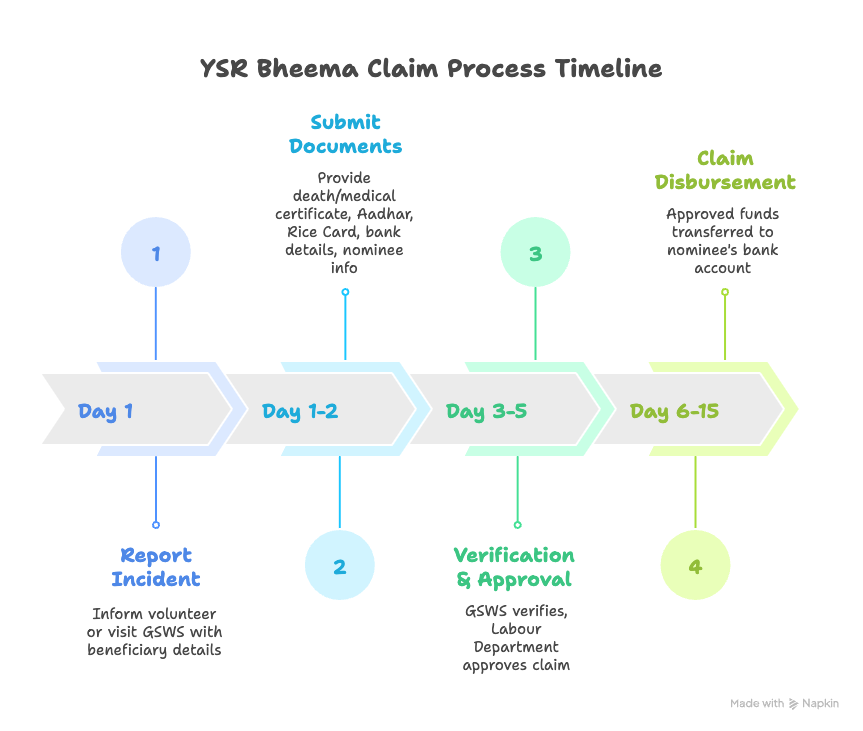

Families of Andhra Pradesh’s unorganised workers can receive financial support through the YSR Bheema Scheme in the event of a death or disability. This is how to submit a claim for the YSR Bheema claim process:

Report the Incident

• Inform the Grama/Ward Volunteer or visit the GSWS Department.

• Provide details of the deceased or disabled beneficiary.

Submit Required Documents

• Death Certificate (for natural or accidental death claims).

• Medical Certificate (for disability claims).

• Aadhar Card & Rice Card of the beneficiary.

• Bank Account Details (for fund transfer).

• Nominee Details (to receive the claim amount).

Verification & Approval

• The GSWS Department verifies the documents.

• The claim is forwarded to the Labour Department for approval.

Claim Disbursement

• Approved claims receive ₹1 lakh to ₹5 lakh, depending on the type of claim.

• The amount is directly transferred to the nominee’s bank account within 15 days

Key of YSR Bheema guidelines

Eligibility:

• Primary breadwinners of BPL families.

• Age group: 18 to 70 years.

• Must have a Rice Card issued by the government.

Insurance Coverage:

• Rs 5 lakh for accidental death or total disability (18-50 years).

• Rs 3 lakh for accidental death or total disability (51-70 years).

• Rs 2 lakh for natural death (18-50 years).

Premium Payment:

• 100% paid by the Andhra Pradesh government.

• Beneficiaries contribute ₹15 per year.

Claim Process:

• The nominee must submit a death/disability certificate, an Aadhar card, and bank details.

• Claims are verified by the GSWS Department and approved by the Labour Department.

• Funds are directly transferred to the nominee’s bank account.

The YSR Bheema eligibility list 2020

The primary breadwinners of BPL families in Andhra Pradesh who fulfil the following requirements are listed as eligible for the YSR Bheema Pathakam Scheme in 2020:

Eligibility

• Age Group: 18 to 70 years.

• Income Status: Must belong to a Below Poverty Line (BPL) family.

• Identification: Must have a Rice Card issued by the government.

• Occupation: Unorganized sector workers.

FAQ Of YSR Bheema Scheme

Q. What is YSR Bheema scheme?

A. The YSR Bheema Scheme is an insurance program that the Government of Andhra Pradesh established to offer financial security to the families of low-wage and unorganised workers in the event of accidents

Q. From where can we check the YSR Bheema Latest Update?

A. You can check the latest updates on the YSR Bheema Scheme from official sources and government portals.

Q. From where can we get YSR Bheema Money?

A. If you are a qualified beneficiary, the funds from the YSR Bheema Scheme can be transferred straight into your bank account. Within 15 days of the claim, the Andhra Pradesh government makes sure the insurance money is deposited into the nominee’s account.

I am Om, a passionate digital marketer certified by HubSpot with over 2 years of experience in content writing and SEO. With a strong background in digital marketing and a knack for creating engaging and informative content, I founded VolunteerBhadra.com to bridge the information gap and help individuals make informed decisions.