The Post Office RD Scheme is a government scheme that helps you save. You can join this government scheme starting from just Rs 100 per month, and at the same time, you can make your future financially stable. We will tell you step by step how to take advantage of the Post Office RD Scheme.

Why Choose Post Office RD Yojana?

If you are good at saving your money and you invest money in this scheme every month for the next 5 years, then your money will remain safe under sovereign guarantee, with zero market risk!

Key Perks:

- Start Small: Start with ₹100/month—easy to start!

- High Safety: Government Savings Scheme = 100% Money Protection.

- Great Returns: Earn 6.7% p.a. interest (compounded quarterly).

- No Max Limit: Save ₹500, ₹5,000, or even ₹10,000/month!

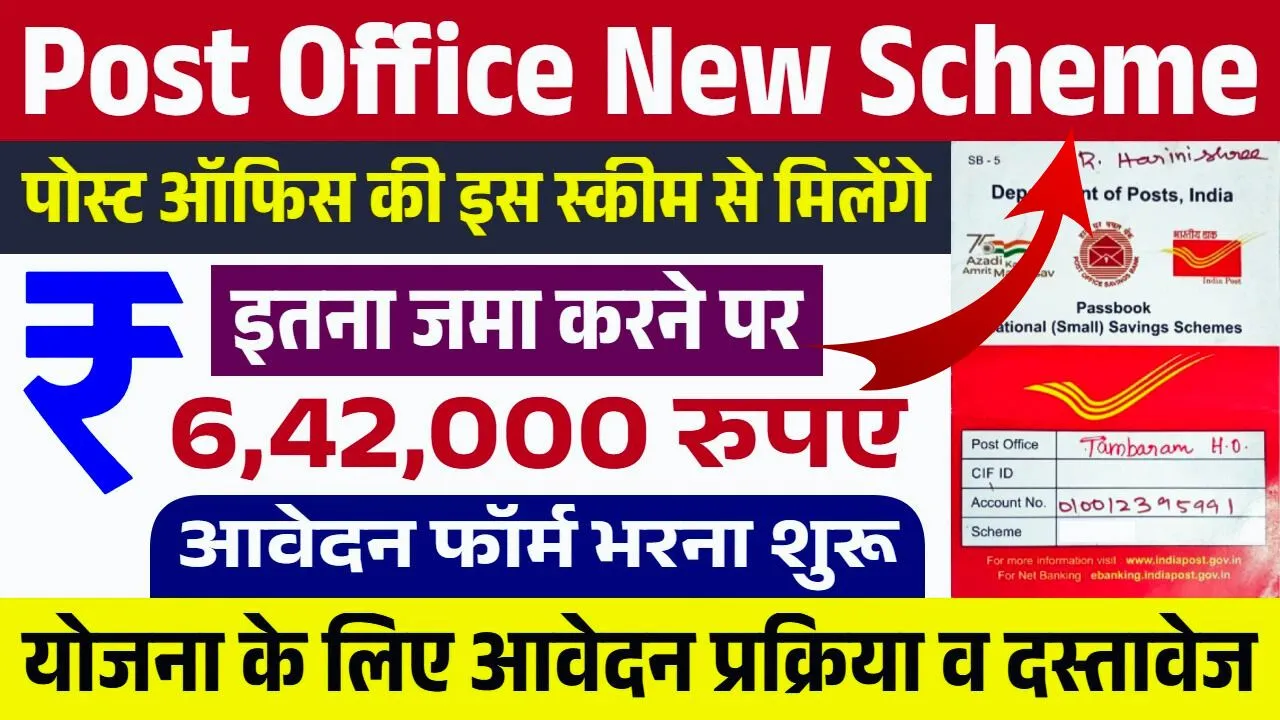

How Much Can You Earn?

| Monthly Deposit | Total 5-Year Deposit | Estimated Interest (@6.7%) | Final Maturity Value |

|---|---|---|---|

| ₹100 | ₹6,000 | ~₹420 | ₹6,420 |

| ₹10,000 | ₹6,00,000 | ~₹42,000 | ₹6,42,000 |

Note: Interest calculations are approximate. Actual returns may vary slightly.

Who Is Eligible For the Post Office RD Scheme?

This Small Savings Scheme is perfect for:

- Salaried individuals & homemakers.

- Students are planning future goals.

- Anyone seeking fixed, low-risk income.

Minors can join via guardians!

Documents Required

Opening an account is easy! Submit the listed document at your nearest post office.

- Aadhaar Card

- PAN Card

- Passport-sized photo

- Address proof (Electricity bill/Voter ID)

Tax & TDS Rules

- Interest is taxable under your income slab.

- TDS on RD applies if the annual interest crosses ₹40,000.

- Submit Form 15G/15H (if eligible) to avoid TDS deduction.

How to Open Your RD Account

Follow these simple steps:

- Visit your nearest post office.

- Fill out the application form and submit documents.

- Deposit your first installment (min. ₹100).

- Use the IPPB app to manage deposits online!

Pro Tip: Set up auto-debit via India Post Payments Bank (IPPB) for seamless savings.

Why the Post Office RD Yojana Wins!

- Flexibility: Increase deposits anytime.

- Loan Facility: Borrow against your RD scheme after 1 year.

- Premature Closure: Allowed after 3 years (small penalty applies).

The Post Office RD scheme will help you in making a good profit from your small monthly savings, and that too with the security of the post office and good returns. This can be a great choice for us to start investing without taking any risk, so start today so that your future is secure.

Disclosure: VolunteerBhadra

This article is for informational purposes only. Interest rates & rules may change. Verify details via the India Post Official Portal before investing.

I am Om, a passionate digital marketer certified by HubSpot with over 2 years of experience in content writing and SEO. With a strong background in digital marketing and a knack for creating engaging and informative content, I founded VolunteerBhadra.com to bridge the information gap and help individuals make informed decisions.